Florida’s Solar Insurance Rules: What Every System Owner Must Know

Florida’s solar insurance requirements demand careful attention from both new and existing system owners to protect your solar investment. Property owners must maintain comprehensive coverage that specifically addresses photovoltaic systems, with minimum liability coverage of $1 million for residential installations and $2 million for commercial properties.

Recent legislation requires solar installations to be explicitly listed on homeowner’s insurance policies, with documentation proving adequate coverage before system activation. Insurance policies must cover damage from natural disasters, electrical malfunctions, and potential third-party claims related to system operation.

Smart system owners supplement standard coverage with specialized solar equipment insurance that addresses unique risks such as production loss, equipment breakdown, and inverter failure. This comprehensive approach ensures full compliance with state regulations while safeguarding against potential financial losses in Florida’s dynamic climate conditions.

These requirements reflect Florida’s commitment to sustainable energy adoption while maintaining strict safety and liability standards for all stakeholders in the solar energy ecosystem.

Mandatory Insurance Requirements in Florida

Property Insurance Coverage

Florida law requires property insurance coverage for solar installations to protect both the system and the property it’s installed on. Homeowners must ensure their existing property insurance policy explicitly covers solar equipment, or they may need to obtain additional coverage specifically for their solar installation.

The minimum required coverage typically includes protection against damage from natural disasters such as hurricanes, lightning strikes, and hail, which are common in Florida. Insurance policies must also cover potential structural damage to the roof or building structure resulting from the solar installation.

Most insurers require professional installation by licensed contractors and compliance with Florida Building Code standards to maintain valid coverage. System owners should maintain documentation of regular maintenance and inspections, as these may be required for insurance claims.

Coverage limits should reflect the full replacement value of the solar system, including installation costs. Property owners should review their policies annually to ensure adequate coverage as system values and replacement costs may change over time. Many insurers also recommend additional liability coverage to protect against potential damage to neighboring properties or injuries related to the solar installation.

Liability Insurance Requirements

In Florida, solar contractors and installers must maintain comprehensive liability insurance as mandated by state regulations. The minimum requirement is $1 million in general liability coverage per occurrence, which protects against property damage and bodily injury claims that may arise during installation or maintenance of solar systems.

Contractors must also carry workers’ compensation insurance if they have four or more employees, ensuring protection for workers involved in solar installations. The coverage extends to both residential and commercial solar projects, with some municipalities requiring additional coverage based on project scope and value.

For enhanced protection, many solar contractors opt for higher coverage limits, typically ranging from $2 million to $5 million, particularly for large-scale commercial installations. The liability policy must specifically include coverage for solar-related activities and remain active throughout the contractor’s licensing period.

Property owners should verify their contractor’s insurance coverage before beginning any solar installation project, requesting certificates of insurance that clearly show coverage limits and expiration dates. It’s also advisable to ensure that the insurance policy includes completed operations coverage, protecting against issues that might arise after the installation is complete.

Additional Coverage Considerations

Equipment Breakdown Coverage

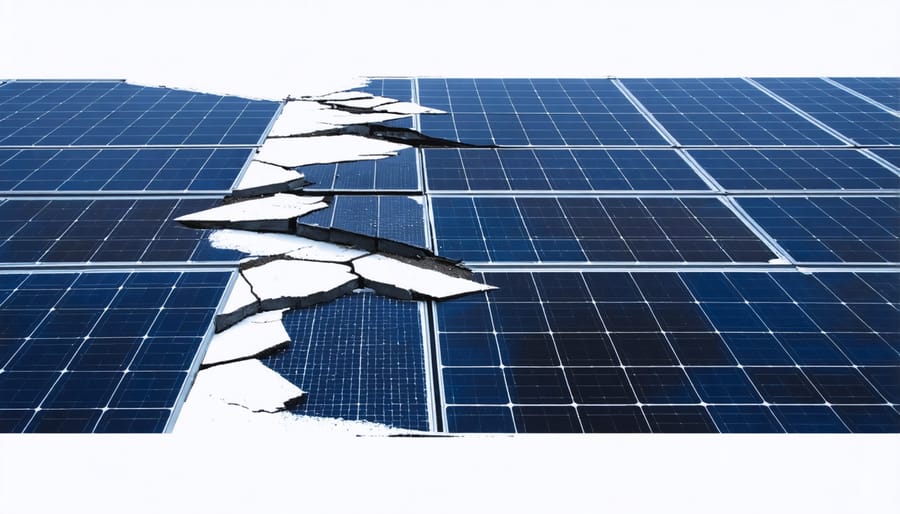

Equipment breakdown coverage is a crucial component of solar insurance in Florida, protecting system owners against mechanical and electrical failures that can disrupt energy production. This specialized coverage addresses unexpected breakdowns of critical components such as inverters, photovoltaic panels, monitoring systems, and other essential equipment.

The coverage typically includes repair or replacement costs for damages caused by short circuits, power surges, mechanical breakdowns, and electrical arcing. It’s particularly valuable for sophisticated solar installations with multiple components and interconnected systems that could be affected by a single point of failure.

Florida’s climate presents unique challenges to solar equipment, including exposure to intense heat, humidity, and severe weather conditions. Equipment breakdown coverage helps mitigate these risks by ensuring that sudden and accidental equipment failures don’t result in significant financial losses.

Most policies cover labor costs for qualified technicians, emergency repairs, and temporary equipment rental when necessary. Some insurers also offer coverage for business interruption losses if the system failure affects commercial operations.

When selecting equipment breakdown coverage, it’s essential to review the policy’s specifics regarding:

– Coverage limits and deductibles

– Excluded components or circumstances

– Response time guarantees

– Preferred repair network access

– Preventive maintenance requirements

This coverage complements standard property insurance and helps ensure continuous operation of your solar investment while maintaining compliance with Florida’s insurance requirements.

Weather-Related Coverage

Florida’s unique weather patterns present specific challenges for solar system owners, making comprehensive insurance coverage essential. The state experiences frequent hurricanes, tropical storms, and intense lightning activity, all of which can potentially damage solar installations.

Insurance policies for solar systems in Florida must specifically address wind damage from hurricanes and tropical storms. Most carriers require installations to meet Miami-Dade County’s stringent wind resistance standards, which mandate solar panels to withstand wind speeds of up to 180 mph. Additionally, mounting systems must undergo rigorous testing and certification to ensure they can handle extreme weather conditions.

Lightning protection is another crucial consideration, given that Florida leads the nation in lightning strikes. Insurance providers typically require the installation of surge protectors and proper grounding systems to mitigate lightning-related damage risks. These protective measures must be professionally installed and certified to maintain valid coverage.

Flood insurance considerations are also vital, particularly in coastal and low-lying areas. While standard solar insurance policies may cover rain damage, separate flood insurance might be necessary to protect against storm surge and rising water damage to ground-level components.

To maintain valid coverage, system owners must conduct regular inspections and document that their installations meet all weather-related safety requirements. This includes periodic checks of mounting hardware, waterproof seals, and electrical connections, especially before and after major weather events.

Insurance Documentation and Compliance

Documentation Requirements

To maintain compliance with Florida’s solar insurance requirements, property owners must maintain specific documentation and certificates. The essential paperwork includes a valid Certificate of Insurance (COI) that clearly outlines coverage limits and policy details. This document should explicitly mention solar panel coverage and any specific endorsements related to renewable energy systems.

Property owners should also keep detailed installation records, including permits and inspection certificates from certified Florida solar contractors. These documents verify that the system meets state building codes and safety standards, which is crucial for insurance validity.

Additionally, maintain records of:

– Annual maintenance inspections

– Professional cleaning services

– Equipment warranties and guarantees

– System performance reports

– Any repairs or modifications

– Weather-related damage claims

For business properties, additional documentation may include business interruption coverage certificates and liability insurance specific to commercial solar installations. Keep digital copies of all documents and store originals in a secure, water-resistant location. Update these records annually and after any system modifications or insurance policy changes to ensure continuous coverage compliance.

Compliance Monitoring

Florida’s solar compliance requirements necessitate regular monitoring and periodic reviews to maintain valid insurance coverage. System owners must conduct quarterly assessments of their insurance documentation and coverage levels to ensure alignment with current state regulations. These reviews should include verification of policy status, coverage limits, and any updates to system modifications that might affect insurance terms.

Insurance providers typically require annual inspections of solar installations to maintain coverage validity. These inspections assess system condition, safety features, and compliance with local building codes. Property owners should maintain detailed records of these inspections, including photographs, maintenance logs, and professional certification documents.

Documentation updates are crucial when system modifications occur or when insurance policies undergo renewal. System owners should promptly notify their insurance providers of any alterations to the solar installation, including repairs, upgrades, or expansions. This proactive approach helps prevent coverage gaps and ensures continuous protection under Florida’s insurance requirements.

Cost Implications and Insurance Selection

The financial implications of solar insurance in Florida vary significantly based on several factors, including system size, location, and coverage level. Typically, homeowners can expect to pay between €300-800 annually for comprehensive coverage, though costs may differ based on specific circumstances and provider selection. When exploring solar financing options, it’s crucial to factor in these insurance costs as part of the total investment.

When selecting an insurance provider, prioritize companies with specific experience in solar system coverage and a strong track record in Florida’s renewable energy sector. Look for providers offering tailored policies that address both standard requirements and region-specific risks, such as hurricane protection and equipment breakdown coverage.

Key considerations for provider selection include:

– Financial stability ratings (A-rated carriers recommended)

– Claims processing efficiency and customer service quality

– Flexibility in coverage options and policy customization

– Experience with solar installations in Florida’s climate

– Ability to meet all state-mandated coverage requirements

Consider obtaining quotes from multiple providers to ensure competitive pricing while maintaining adequate coverage. Many insurers offer bundling options with existing home insurance policies, potentially reducing overall costs. Remember that the least expensive option isn’t always the most cost-effective long-term solution – focus on finding a balance between comprehensive coverage and reasonable premiums that protect your solar investment effectively.

Review policy terms annually to ensure coverage remains appropriate as system values depreciate and technology evolves. This proactive approach helps maintain optimal protection while potentially reducing premium costs over time.

Understanding and meeting Florida’s solar insurance requirements is crucial for protecting your investment and ensuring compliance with state regulations. From mandatory property insurance coverage to optional add-ons like equipment breakdown protection, proper insurance safeguards both your system and financial interests. Remember to regularly review your coverage, maintain accurate documentation, and stay informed about policy updates or changes in state requirements. Working with qualified insurance providers who understand solar systems can help ensure comprehensive protection. For new solar system owners, we recommend conducting an annual insurance review and keeping detailed records of all coverage changes and claims. Taking these proactive steps will help maintain continuous protection while maximizing the long-term benefits of your solar investment.

Leave a Reply