Double Your Solar Savings: How Roof Replacement Tax Credits Maximize Your Panel Installation

Maximize your solar investment by combining roof replacement with solar panel installation to unlock substantial tax benefits across Europe. Recent EU regulations allow homeowners to claim up to 30% of combined installation costs, including necessary roof modifications, through the Enhanced Solar Investment Initiative. This strategic approach not only ensures optimal panel placement but also addresses crucial structural requirements while significantly reducing overall project expenses.

Property owners planning solar installations within the next 12 months can particularly benefit from this integrated solution. The comprehensive tax credit covers essential roof reinforcement, weatherproofing upgrades, and structural modifications required for solar panel mounting systems. This forward-thinking policy reflects the EU’s commitment to sustainable energy adoption while acknowledging the practical challenges homeowners face during solar conversions.

Understanding these dual-purpose tax incentives transforms what might seem like two separate expensive projects into one cost-effective energy solution. Whether managing a residential property or commercial building, this opportunity to simultaneously modernize your roof and transition to solar power represents a pivotal moment in European energy efficiency initiatives.

Understanding the Solar Tax Credit Framework

The Solar Investment Tax Credit (ITC)

The Solar Investment Tax Credit (ITC) represents one of the most significant financial incentives for solar energy adoption in Europe. This mechanism allows property owners to deduct a substantial percentage of their solar installation costs from their tax liability. As of 2024, eligible participants can claim up to 30% of the total system costs, including both equipment and installation expenses.

For integrated projects combining roof replacement with solar installation, the ITC offers particular advantages. The credit applies to necessary roof modifications and structural improvements that directly support the solar system’s installation. However, it’s important to note that only the portion of roof work directly related to solar panel installation typically qualifies for the credit.

To maximize the benefits, property owners must ensure their projects meet specific criteria, including professional installation requirements and equipment certification standards. The credit can be claimed in the tax year when the installation is completed, with any excess amount potentially carried forward to subsequent years. Documentation requirements include detailed invoices, certification of equipment, and proof of installation completion.

For optimal results, consulting with tax professionals and certified solar installers familiar with European regulations is strongly recommended before proceeding with your project.

Country-Specific Incentives

Several European countries offer attractive incentives for combined roof replacement and solar panel installations. Germany leads with its KfW program, providing up to 40% coverage of total project costs through grants and low-interest loans when coupling roof renovation with solar installation. France’s MaPrimeRénov scheme offers tiered benefits based on household income, with maximum benefits reaching €20,000 for comprehensive roof and solar projects.

In Italy, the Superbonus 110% initiative allows homeowners to claim up to 110% of eligible expenses through tax deductions when combining energy efficiency improvements with solar installations. Spain’s regional programs vary, but most autonomous communities offer subsidies ranging from 25% to 45% of project costs when integrating roof improvements with solar solutions.

The Netherlands provides a combination of national and municipal incentives, including VAT exemptions on solar installations and specific roof renovation grants in selected cities. Denmark focuses on energy efficiency packages, offering up to 30% of total costs for projects that combine structural improvements with renewable energy solutions.

These incentives often require professional assessment and certification to ensure compliance with local building and energy regulations.

Roof Replacement Eligibility Requirements

Qualifying Expenses

When claiming tax credits for solar panel installations combined with roof work, understanding the key factors for roof replacement is crucial. Eligible expenses typically include structural reinforcement work necessary to support solar panels, including rafters, trusses, and additional bracing. The replacement or repair of roof decking, underlayment, and weatherproofing materials directly related to solar installation also qualify.

Qualifying materials encompass:

– Structural lumber and engineered wood products

– Roofing membranes and waterproofing materials

– Solar panel mounting systems and attachment hardware

– Flashing and water-diversion components

– Necessary electrical conduit and wiring infrastructure

However, purely cosmetic roof improvements or repairs unrelated to solar panel installation do not qualify. The tax credit specifically covers expenses that are functionally necessary for the solar energy system’s installation and operation. Documentation must clearly demonstrate the connection between roof work and solar panel installation, including detailed invoices separating solar-related expenses from general roofing costs.

To ensure compliance, maintain comprehensive records of all materials and labour costs, engineering assessments, and installation plans. These documents should explicitly show how each expense contributes to the solar system’s functionality and safety requirements.

Timing Considerations

Strategic timing is crucial when planning a combined roof replacement and solar panel installation to maximize available tax credits. For European homeowners, it’s essential to complete both projects within the same tax year to ensure eligibility for the full benefit package. Most EU member states require project completion and documentation submission by December 31st of the claiming year.

Consider seasonal factors when scheduling your project. Late spring to early autumn typically offers optimal conditions for both roof work and solar installation, with reduced risk of weather-related delays. However, contractor availability during these peak periods may be limited, so advance booking is recommended, ideally 3-6 months before your intended start date.

For maximum financial benefit, align your project with annual energy efficiency incentive renewals, which often occur at the start of each calendar year. Many European countries announce enhanced incentives during this period, potentially increasing your savings potential.

Remember that tax credit rates and eligibility criteria may change annually. Current European Green Deal initiatives suggest maintaining generous incentives through 2030, but specific terms vary by country. To ensure you don’t miss out on available benefits, consult with a qualified tax professional and renewable energy specialist before finalizing your project timeline.

Keep detailed records of all project phases, including initial assessments, contractor agreements, and completion certificates, as these will be crucial for your tax credit application.

Maximizing Your Tax Benefits

Documentation Requirements

To successfully claim your tax credit for a combined roof replacement and solar panel installation, you’ll need to maintain comprehensive documentation throughout the project. Start by collecting detailed quotes and contracts that clearly distinguish between solar installation costs and roofing work. These documents should explicitly demonstrate how the roof replacement directly supports or is necessary for the solar panel installation.

Essential documentation includes:

– Itemised invoices showing separate costs for roofing materials, solar panels, and labour

– Certification of your solar installation from a MCS-accredited installer

– Energy Performance Certificate (EPC) for your property

– Proof of payment for all work completed

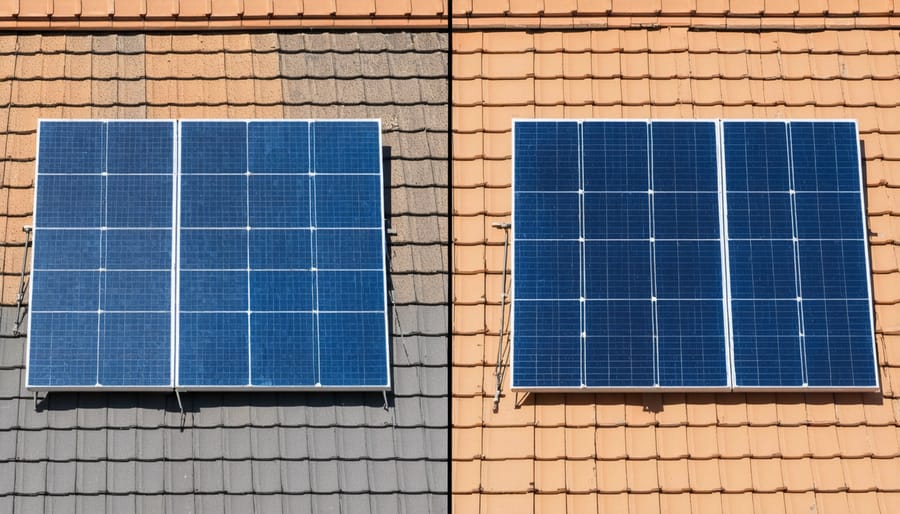

– Photographs documenting the condition of the old roof and the completed installation

– Technical specifications of the installed solar system

– Building permits and planning permissions where required

– Written confirmation from your installer explaining why roof replacement was necessary for solar installation

Keep all correspondence with your installers, including emails and written assessments of your roof’s structural requirements. For tax authorities, maintain records of your property’s energy consumption before and after installation, as this helps demonstrate the system’s effectiveness.

Remember to obtain manufacturer warranties for both the roofing materials and solar components, as these may be required for insurance purposes and future claims. Store digital copies of all documents in multiple locations and retain physical copies in a secure place. Most European tax authorities require you to maintain these records for at least five years after claiming the credit.

Cost Allocation Strategies

When planning a combined roof replacement and solar panel installation, proper cost allocation is crucial for maximising tax benefits. The key is to clearly distinguish between solar-specific expenses and general roofing costs. Start by obtaining itemised quotes from contractors that separately detail solar installation components and roofing materials.

Generally, expenses directly related to solar panel installation, including mounting hardware, wiring, and structural reinforcements specifically for panels, qualify for solar tax credits. Basic roofing materials and labour typically don’t qualify, but certain roof modifications necessary for solar installation might be eligible.

To effectively calculate your solar ROI and tax benefits, maintain detailed documentation of all expenses. Create separate cost categories for:

– Solar panels and inverters

– Solar mounting systems

– Solar-specific roof modifications

– Standard roofing materials

– Labour costs (divided between solar and roofing work)

Consider working with a tax professional familiar with renewable energy incentives in your region. They can help determine which portions of your project qualify for tax credits and ensure proper allocation of expenses. Keep all invoices, contracts, and correspondence with contractors to support your tax claims.

Remember that regulations vary across European countries, so verify local requirements for cost allocation. Some jurisdictions may offer additional incentives for integrated solar roof solutions, which could affect how you structure your project costs.

Professional Support and Implementation

Choosing Qualified Providers

Selecting qualified providers for your roof replacement and solar panel installation is crucial for maximizing available tax credits and ensuring project success. Look for contractors with dual expertise in both roofing and solar installations, as this combination ensures seamless integration between systems and proper consideration of ongoing maintenance requirements.

Verify that potential contractors hold relevant European certifications, including MCS (Microgeneration Certification Scheme) certification where applicable. Request references from previous integrated roof and solar projects, particularly those completed within the past three years. Experienced providers should readily share documentation of successful installations and demonstrate knowledge of local building regulations and tax credit requirements.

Consider providers who offer comprehensive project management services, including assistance with permit applications and tax credit documentation. They should provide detailed proposals outlining materials, timeline, warranty terms, and clear cost breakdowns that distinguish between roofing and solar components for tax purposes.

Prioritize companies with established presence in your region and proven track records of after-installation support. Request multiple quotes and evaluate them based on value rather than just price, keeping in mind that quality workmanship directly impacts both energy generation efficiency and tax credit eligibility. Ensure your chosen provider carries appropriate insurance coverage and offers warranties that align with tax credit requirement periods.

Project Timeline Planning

Efficient project timeline planning is crucial when combining roof replacement with solar panel installation. The key to maximising tax benefits lies in careful coordination between roofing contractors and solar installers. Generally, a complete project spans 4-8 weeks, depending on roof complexity and weather conditions.

Begin by scheduling a comprehensive roof assessment at least 2-3 months before your planned solar installation process. This evaluation determines necessary repairs and ensures structural integrity for solar panel mounting. Allow 1-2 weeks for obtaining permits and documentation for both roof replacement and solar installation.

The actual roof replacement typically requires 3-5 working days. Schedule this phase during a period of stable weather forecasts. Once completed, allow a minimum 48-hour settling period before commencing solar panel installation. Solar panel mounting and electrical work usually takes 2-3 days for an average residential installation.

Consider seasonal timing – spring and autumn often offer ideal conditions for both activities. Summer installations may qualify for better tax incentives in some European regions, but weather conditions might affect work schedules. Documentation for tax credits should be collected throughout the project, including dated photographs, invoices, and certification papers from both roofing and solar contractors.

Remember to coordinate with your utility provider early in the planning phase, as grid connection approval might influence your project timeline and subsequent tax credit claims.

Embarking on a roof replacement project combined with solar panel installation represents a significant opportunity for European homeowners to enhance their property’s value while contributing to environmental sustainability. The available tax credits make this dual investment particularly attractive, offering substantial financial benefits that can significantly reduce the overall project costs.

To maximise these benefits, remember to thoroughly document your project, including obtaining detailed quotes that clearly separate roofing and solar installation costs. Working with certified contractors who understand both local building regulations and solar installation requirements is crucial for ensuring your project qualifies for all applicable tax credits.

Consider taking these next steps to move forward with your project:

– Schedule professional assessments of both your roof condition and solar potential

– Request detailed quotes from certified contractors

– Consult with tax professionals familiar with renewable energy incentives

– Review current tax credit rates and deadlines in your region

– Prepare necessary documentation for tax credit applications

Remember that timing is crucial, as tax credit programs may have specific deadlines or changing rates. By planning carefully and understanding all available incentives, you can optimise your investment while contributing to Europe’s renewable energy goals. Consider reaching out to local renewable energy associations or certified solar installers who can guide you through the process and ensure you meet all eligibility requirements for maximum tax benefits.

Leave a Reply